Why Shouldn´t I Do More of It?

¿Por qué no hacer más de lo mismo?

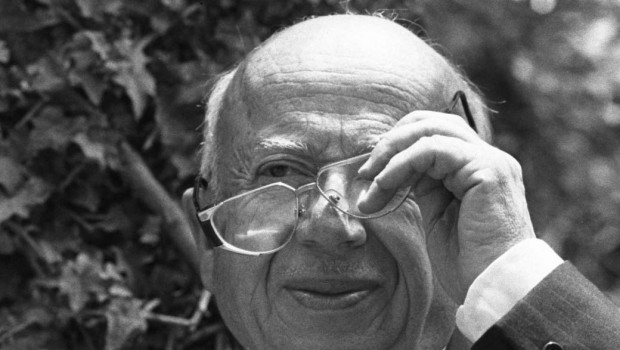

Muhammad Yunus

2006 Nobel Peace Prize winner, Muhammad Yunus, spoke to the community of University of Saint Thomas, the first and only college in Texas to implement the Micro-Credit Program of which Yunus himself is the pioneer. He explained how it all started and the benefits that the micro-credit program is achieving for the people living below the poverty threshold. Yunus gave his speech in an act held by the World Affairs Council.

* * *

I come from the university campus. I was teaching in one of the universities in Bangladesh right after it became an independent country, in 1971. It had been struck by famine, to the point where people were dying of hunger. At the time, I found it extremely difficult to teach economics in a classroom and go outside and see people dying. I thought that there was no way I could help these people with my knowledge. The knowledge I had concerned overcoming problems in economics, but as a person, as a human being, I could be out there, and see if I could be useful to another human being in distress.

So I started doing that, because the village was just next to our university campus. It was not something I was doing as a long distance work. While visiting the village every day, going downtown to help people in whatever way I could, I saw how loan sharks made people’s lives miserable. So I wrote a list of people who were being bothered by the loan sharks. When the list was complete, there were 42 names on it, and the borrowed money totalled 27dollars. I was shocked, because here in the classroom we talk about national development plans, investing millions and billions of dollars for industrialization, infrastructure development, all kinds of big projects in the name of helping poor people get out of poverty. Yet after all these years, people were not waiting for millions or billions of dollars, they just lacked a few pennies to move ahead with their lives. That was how loan sharks took advantage of them and made their lives absolutely miserable for lending to them.

Going to the shops, I suddenly realized that such a difficult problem had an easy solution. The idea came to my mind that if I gave the 27 dollars to all these 42 people, they could go and return the money to the loan sharks right away, and I thought that was something I could do immediately. I had no idea what would happen afterward, but since I was doing lots of little things for them, that could have been one more little thing. People were so grateful, they began looking at me as if had descended from heaven. It gave me another idea. If I could make many people so happy with such a small amount of money, why shouldn’t I do more of it? So I thought, I could still give more money from my pocket, but maybe I should do something that could continue even without my presence. I thought, “Why don’t I take these people to the bank, which is located on the campus, and it’s done. They don’t have to go to the loan sharks anymore.”

I was full of enthusiasm; I went to the manager and asked him “Why don’t you lend the money to these people? It’s only a small amount, you will not miss it!” He immediately said “No, it can’t be done.” I said “Why not?” and he answered “because the bank cannot lend money to poor people.” So we went over the whole thing of how banks work. The more we argued, the more stubborn he’d become. Finally, I thought I would try to talk to the senior officials who would understand it better. I did it for several months, trying to find a little opening in the bank so that they would listen to me and help with a little money for poor people. Everybody said no. Out of frustration, I decided something else: why don’t I become guarantor? When I spoke to the bankers, I said, “I’ll become guarantor so you can give them the money. This is your rule, not something I’m inventing, and you don’t have to invent anything.” At least for me, the satisfaction was that I had opened the bank doors to the poor. This time they couldn’t throw me out of the office because I was speaking their language. Finally, after a long series of investigations, they accepted this and agreed to lend money with me as a guarantor. That was the beginning, in 1976.

When I gave the money to the people, the managers said repeatedly “this is the last time you’ll see it.” I said: “I don’t know anything, I’ve never done this before, I’ll try it.” I came up with simple rules that encouraged people to pay back, and it worked out. My students and I worked on this and got the people to do it. I was amazed of the response and encouragement they got. But the bank still said, “Well, you’ve been lucky with the first time, you won’t be so lucky next time,” and I responded: “I’ll try next time too.” I tried it again and it worked the same way, so I went on and on like that. Very soon, the bank started to become more and more reluctant, always fearing this whole thing would collapse, and I wouldn’t be able to pay them back. Seeing their reluctance, I thought I should create a separate bank, because what I saw was a possibility, and banks don’t see that. I wanted to demonstrate it for them, but they ignored me.

That led me to a different direction. It took me a couple of years to persuade the authorities to give me the licenses, but we finally became an independent bank, and since then we continued the work.

The point that I’d like to underline here is that I had no idea what banking was, so when I did it, I used only my common sense. There’s no textbook on banking or anything like that, and when we did all kinds of funny things, people looked at it as if it was completely crazy. People ask me “How did you figure out these rules that you made?” I respond “It was very simple.” Whenever we needed to know how to do or adjust something, we looked at the conventional banks and how they did it, and did the opposite. If you look at what we do, it is almost the exact opposite of the conventional system. Conventional banks’ basic principal is: the more you have the more you get. We reversed it, we say: the less you have, the more attention you get; you’ve got absolutely nothing, you have the highest credit. As simple as that. It makes sense to us but it doesn’t make sense to them, so it’s ok with us.

Before the banks give you the money, everything has to be protected. If you take a dollar, you must have something worth two dollars. This is collateral. From day one, we decided we don’t need any collateral because if somebody doesn’t have anything because he’s poor, where is she going to bring the collateral from? So we didn’t require collateral. We didn’t need any guarantees; you don’t need anyone to sign “ok I’m the guarantee for her.” We didn’t need any of that, and on top of it, we didn’t need any lawyers. In the entire system we have no lawyers; that means no papers from the lawyers, green, blue pieces of paper, signed, sealed, nothing. They go to men to lend money, we go to women; they go to the rich, we go to the poor; rich people own their bank, poor women own ours. It continues to work today all over Bangladesh. We have 7.5 million borrowers, 97% are women, and the return payment is 98%. Our bank doesn’t take any foreign money; neither government money or private donor money and we don’t borrow from anybody because we have so much money ourselves.

Where does the money come from? As a bank we just take deposits wherever we go. We have 2,700 branches all over the country, with 27000 staff. What we do every time our manager goes to open a new branch is tell them we don’t need any money; you simply go there and start collecting the deposits. As soon as you collect them, you start lending the money to the poorest women. We tell them: “We want you become sustainable, you have to reach breakeven point within 12 months,” and they do it, so we don’t have to worry. We have more money in our deposits than the money we lend out.

We lend out half a billion dollars a year in tiny amounts, everybody gets a hundred and fifty dollars, and it changes people’s life. The children of these families go to school because we give them an education. More than 21 thousand students from these families are in medical schools, engineering schools, universities, some are even getting their PhD. Yesterday I met one of these students in Austin and I was surprised. “So, what are you doing here?” I asked, and he said “my mother is a borrower of Grameen bank; I got the education loan and I’m studying in Austin.” He represents a completely new generation out of the old generation.

Many people argue that one needs entrepreneurial ability and special people do work with micro credit. This is absolutely against what I always say: All human beings are entrepreneurs by definition; you don’t have to go and prove anything because that’s what we’ve done for millions of years on this planet. That’s what we did at the bank; we went on our own. When we were in the cave, we didn’t send out job applications to anybody, we just cared about ourselves. As students you’ll find out where this idea of job application comes from. If we have survived these million years beyond our own, we can to do it now. This is entrepreneurial ability is built into all of us, even though society never allows us to make use of it. We don’t even know we have a wonderful gift inside of us. What you need is a good environment to unleash that capacity, and then everything can happen.

To demonstrate this, we have what we did four years back when we introduced a new program: lending money to beggars. Everybody said “Are you sure you can lend money to them?” I said “Well I’ll try, I don’t know.” See, that’s another advantage. When you don’t know anything, you can jump at it. Sometimes, knowing too much creates problems. I didn’t know anything about banking, so I could do anything I wanted, and get away with it. As a result, I said “I don’t know if I’d ever lend money to beggars, but I’ll find out.” I talked to my colleagues and decided first we would talk to them. “Let’s find out how she became homeless, at what point in her life, what we did, what did society do to her, to push her to that frontier.” We did that, and then we told them “as you go door to door for begging, would you like to carry some merchandising, some cookies, some candies, or some toys? Look, you’re not doing anything extra, you go there anyway. Having little boxes of something with you. It won’t hurt, and give people the option; they can still give you something in charity, some food, something that you need, or buy something, or do both. Who cares? You are giving people options. That’s all.”

At the beginning, we thought we were going to have a couple of thousand of them. Whether they had this entrepreneurial ability or they were just going to take the money we didn’t know. If so, we’d lose the money and they wouldn’t come to us anymore. We took a chance. All we said was: “this is a free loan, so you don’t have to worry about money getting bigger every day. It doesn’t get bigger, it stays and there’s no time limit, so don’t worry about money, pay us back whenever you can.”

Today there are more than a hundred thousand beggars in the program. It became so popular, not only among them, but also among our staff, that we became mesmerized by this idea of serving. They had been helping the poor women, and they began serving the beggars. Everybody wanted to help them, so I put a restriction: no one can serve more than X numbers of beggars; initially it was one per person. Because of the demand, I had to increase the number of beggars to four per person. We have more than a hundred thousand beggars with us. Within four years, ten thousand of them have completely stopped begging, some of them have even become personal shoppers.

I’d say the remaining ninety thousand of them are part-time beggars now, because they are mixing begging and selling. When my colleagues get impatient in regards to why it has taken so much time to get out of begging, I say “Look, don’t push them. They are in the process of closing down their begging division; after all these years, it is their business, so don’t expect them to close it right away. At the same time they’re trying to restructure their own business, which takes time. So again, we didn’t train them. We say “people have their own skills, they know what their idea is, and they know how to use it.”

Today, our studies and our monitoring show that 64% of borrowers that have been with Grameen Bank for more than five years, have already crossed the poverty line, they’re above it. Now, a whole new class is coming up, because we have all the children of Grameen families going to school, they have been able to succeed, and some of them are going to higher education. It’s a brand new generation coming out of totally illiterate families. We see possibilities of moving into a world where there will be no poverty left for them.

That’s what Grameen Bank is. We are very happy. We say that “poverty is not created by poor people; poverty is created by the system that we built up ourselves”; that is what poverty is all about. Our system refuses almost 2/3 of the world population from accessing the services. What kind of financing institution is that? They told us this couldn’t be done. We have shown them it can be done, and done better than others. People ask me now “what do you think about the subprime crisis?” And I say “look, we don’t have subprime crisis, subprime is a very risky business. Our business has sub, sub, subprime and we don´t find it risky at all. We feel very comfortable because our return payment has been 98 to 99%.

Now there’s only one concept of what a business should be: a business should be something to make money, nothing else. Profit maximization is the central mission of business, that’s what the textbooks say. I think the people who created those theories assume that human beings have some kind of money-making machine, but human beings are not money-making machines. Money making is an important part of human beings, but that is not the totality of it. A human being is much more than that, so I say “what about the other part, why did you skip that? That’s the most interesting part of a human being, which is giving, caring, sharing, contributing, and so on.”

We can address all those problems the world cannot address. Every morning you read the newspaper to see how much money you’re making, and that’s your entire obsession. And with that kind of obsession, you forget the rest of us.

Muhammad Yunus (Premio Nobel de la Paz 2006) es el creador del Grameen Bank, institución mundialmente reconocida ya que —desde su fundación en 1983— ha beneficiado a más de tres millones y medio de pobres en Bangadesh. El pasado mes de enero, en un acto organizado por el World Affairs Council, el Nobel ofreció la siguiente charla a la comunidad de la University of Saint Thomas, la primera y única universidad en implementar un programa de microcréditos en Texas.

* * *

Vengo del campus universitario. Fui profesor en una universidad de Bangladesh. Inmediatamente después de que éste se convirtiera en un país independiente, en 1971, se sumergió en una situación de hambruna, así que encontraba muy difícil enseñar economía en el aula e ir afuera y ver a personas morir de hambre. Pensé que no tenía manera de ayudarles con mis conocimientos acerca de la economía para superar el problema pero, como persona, podía estar allí intentando ser útil a otro ser humano en la miseria.

Comencé por acercarme a ellos ya que la aldea estaba justo al lado de nuestro campus. No era un trabajo que realizara a larga distancia y, mientras los visitaba a diario, advertí cómo los usureros les hacían la vida imposible. Así que organicé una lista con la gente a la que estos tiburones estaban explotando. Cuando logré completarla, tenía yo 42 nombres con un total de 27 dólares de crédito. Los datos me sorprendieron porque, en clase, hablábamos de planes de desarrollo nacional, de infraestructuras y todo tipo de grandes proyectos bajo el pretexto de ayudar a la gente pobre a salir de la pobreza. Sin embargo, durante todos esos años he podido ver cómo la gente no está esperando millones de dólares, tan sólo quieren unos cuantos céntimos para seguir adelante. Los usureros toman ventaja de eso, realizan el préstamo y les hacen la vida absolutamente imposible.

En una ocasión, mientras iba por las tiendas, advertí cómo un problema, tan complicado aparentemente, tenía una solución fácil. Pensé que si daba esos 27 dólares a las 42 personas, ellas podrían devolver sus préstamos; algo que yo podía hacer de inmediato. No tuve idea entonces de lo que iba a pasar, pero ya que estaba ayudando con otras pequeñas cosas, esto sería parte de la misma labor. A partir de entonces la gente empezó a mirarme como si hubiera bajado de los cielos, o algo así. El hecho dio lugar a otra idea. Si pude ayudar con tan poco dinero, ¿por qué no hacer más de lo mismo? Aún podía darles más dinero de mi bolsillo, pero pensé que debía hacer algo para que ellos continuaran sin mi presencia. Se me ocurrió entonces una posibilidad que me pareció brillante: ¿por qué no llevo a toda esta gente al banco, que está dentro del campus, y asunto resuelto? Ya no necesitarían ir con los agiotistas.

Impulsado por mi entusiasmo fui a ver a un banquero y le pregunté por qué no le prestaban dinero a esta gente: “¡es una cantidad pequeña que no echarán de menos!” La respuesta inmediata fue negativa: “el banco no presta a los pobres”. Hablamos de cómo funcionan los bancos y, entre más conversábamos, más terco se ponía. Finalmente opté por hablar con sus superiores, quienes quizá lo entenderían mejor. Los visité durante meses intentando, sin conseguirlo, que aprobaran mi idea de ayudar a la gente pobre con pequeñas cantidades. Lleno de frustración busqué otra alternativa: ¿por qué no ser yo mismo el garante ante el banco? “Si soy el aval, tú les das el dinero. Ésta es la regla y no estamos inventando nada fuera de la norma”. Esta vez no me podían echar de sus oficinas ya que estábamos hablando en su propio idioma. Finalmente, después de varios estudios, aceptaron la propuesta y accedieron a prestar dinero, conmigo como garante. Este fue el principio, en 1976.

Cuando di el dinero a la gente, los banqueros me dijeron repetidas veces que esa sería la última vez que lo vería. Yo les dije “No lo sé, nunca he hecho esto antes, lo probaré”. Inventé varias normas sencillas para animar a los acreedores a devolver el préstamo, y funcionó. Mis alumnos y yo trabajamos en esto y conseguimos que lo hicieran. Estaba asombrado de la respuesta que recibieron, de los ánimos. En el banco me dijeron “Bien, has tenido suerte esta vez, pero la próxima no será así”; y yo les respondí: “Lo intentaré de nuevo”. Lo hice y volvió a funcionar; y así una y otra vez. El banco pronto se volvió reticente, por miedo a que yo no pudiera pagarles de vuelta. Notando su desconfianza, pensé que debía crear un banco por separado, pues lo que yo veía como una posibilidad, los bancos no la advertían. Aunque intenté demostrarlo, ignoraron todos mis intentos.

¿Así que por qué no crear mi propio banco? Eso me condujo hacia otra dirección. Me costó un par de años persuadir a las autoridades para que me dieran las licencias. Finalmente nos convertimos en un banco independiente, y desde entonces hemos continuado con el trabajo.

Lo que me gustaría remarcar aquí es que no tenía la menor idea de lo que era trabajar un banco, así que cuando lo hice, simplemente utilicé el sentido común. No hay un libro de texto que lo enseñe y cuando hicimos todo tipo de cosas divertidas, algunos pensaron: “ah, esto es de locos”, pero nosotros igualmente nos divertimos. La gente me pregunta cómo llegué a dar con las normas de mi programa, y les digo que fue muy sencillo. Siempre que necesitábamos una simple norma, cómo hacer algo, cómo ajustarlo, sencillamente mirábamos a los bancos convencionales y lo invertíamos. Si observan lo que hacemos, verán que es casi lo contrario a los bancos convencionales. La norma principal de éstos es: cuanto más tienes, más recibes. Nosotros lo invertimos, nosotros decimos: cuanto menos tengas, más atención recibirás; si no tienes nada, tienes el mayor crédito. Tan sencillo como esto. Tiene sentido para nosotros pero no para los bancos convencionales; eso no nos importa.

Antes de que un banco dé el dinero tienen que protegerlo todo. Si les pides un dólar tienen que verte con algo cuyo valor sea de dos dólares. Esto es colateral. Nosotros desde el primer día dijimos que no necesitamos “colateral” porque si alguien no tiene nada porque es pobre, ¿de dónde nos traerá el “colateral”? Así que no tenemos una garantía; no necesitas a nadie que firme “yo soy su garantía”. No lo necesitamos, y además, no tenemos abogados. No hay abogados en toda nuestra estructura; esto significa: nada de papeles azules, verdes, firmados, sellados, etc.; nada de nada. Ellos prestan dinero a los hombres, nosotros a las mujeres; ellos van a los ricos, nosotros a los pobres; a su banco lo controla gente rica, al nuestro lo controlan las mujeres pobres. Este sistema funciona hoy en día, funciona en todo Bangladesh. Tenemos a 7.5 millones de gente a la que prestamos dinero, el 97% son mujeres, y la devolución del préstamo asciende al 98%. Nuestro banco no pide dinero a nadie de fuera, ni al gobierno ni a donantes, no pedimos dinero a nadie porque ya tenemos mucho dinero generado por nosotros mismos.

¿De dónde viene el dinero? En tanto que somos un banco, pedimos depósitos allá donde vamos. Tenemos 2,700 sucursales en todo el país con 27 mil empleados. Lo que hacemos cada vez que un gerente va a abrir una nueva sucursal es decirles que no necesitamos dinero; sencillamente se va allí y se empieza a recoger depósitos. Tan pronto como se tiene el dinero, se reparte entre las mujeres más pobres. “Queremos que seas solvente, tienes que lograr déficit cero en doce meses”, y lo hacen, así que no nos preocupamos. Tenemos más dinero en nuestros depósitos que el dinero que prestamos.

Anualmente prestamos medio billón de dólares; en pequeñas cantidades cada persona recibe ciento cin cuenta dólares, y cambia la vida de la gente. Los hijos de estas familias están yendo a la escuela, les damos una educación. Más de 21 mil estudiantes de estas familias están ahora en escuelas de medicina, de ingeniera; están en universidades y algunos, incluso, cursando su doctorado. Ayer conocí a uno de estos chicos en Austin; estaba impresionado. “¿Qué haces aquí?” le dije, y me respondió: “mi madre pidió prestamos al Grameen Bank, y pude educarme, conseguir una beca y aquí estoy en Austin”. Esta es una nueva generación nacida de la vieja generación.

Mucha gente piensa que se necesita iniciativa empresarial y personal preparado para trabajar en los microcréditos. Sin embargo, esto va en contra de lo que siempre digo: todos los seres humanos son empresarios por definición; no tienes que demostrar nada porque eso es lo que hemos hecho durante millones de años en este planeta. Esto es lo que hicimos: valernos por nosotros mismos. Cuando vivíamos en cuevas no mandábamos currículos a nadie, tan sólo nos preocupábamos por nosotros mismos. Como estudiantes que son verán de dónde viene esta idea de enviar currículos. Si hemos sobrevivido millones de años valiéndonos por nosotros mismos, confiamos en hacerlo ahora; esto es la habilidad empresarial que tenemos, a pesar de que la sociedad no nos ha permitido hacer uso de ella. Ni siquiera supimos que teníamos un regalo tan bello dentro de nosotros. Lo que necesitas es un buen ambiente para dejar aflorar esa capacidad; entonces todo pueda pasar.

Para demostrarlo tenemos lo que hicimos hace cuatro años, cuando introdujimos un nuevo programa: prestar a los mendigos. Todos nos advitieron: “¿seguro que puedes prestar a los pordioseros?”, a lo que yo respondí: “lo intentaremos, no lo sé”. ¿Ven?, eso es una ventaja. Cuando no se sabe nada, te puedes lanzar a hacerlo. A veces saber crea problemas. Yo no sabía nada de banking, así que podía intentar lo que quisiera y salirme con la mía. Como resultado expresé: “no sé si prestaría a los limosneros, pero a ver qué pasa”. Hablé con mis socios y decidimos que, primero, había que hablar con ellos, entender por qué estaban mendigando, en qué punto de su vida la sociedad les empujó a mendigar. Lo hicimos y les dijimos “mientras vas puerta por puerta, ¿por qué no traes contigo algo para vender, galletas, caramelos o juguetes? ¿Qué crees que te podrían comprar? Llevando contigo algo para vender no te hará ningún mal sino que ofereces opciones. Ellos aún pueden darte algo extra de caridad, como comida o algo que necesites, o comprar lo que les ofreces, o ambas cosas. ¿Qué más da? Le estás dando opción a la gente”. Eso es todo. Les encantó la idea.

Al principio pensamos que sólo tendríamos unos cuantos pordioseros. Si tendrían o no esa habilidad empresarial o si sólo se quedarían con el dinero, no lo sabíamos. De ser así tomarían el dinero y nunca los volveríamos a ver. Lo probamos. Todo lo que aclaramos fue: “esto es un préstamo, el dinero no crecerá, será el mismo y sin límite de tiempo, así que no te preocupes por el dinero; páganos cuando puedas”.

Hoy tenemos a más de cien mil mendigos en el programa. Se volvió muy popular, no sólo entre ellos sino entre nuestros trabajadores, que se involucraron mucho con la idea de servirlos. Han estado apoyando a las mujeres pobres, ahora a los mendigos. Todos los querían ayudar, así que puse una restricción: nadie puede ayudar a más de X número de mendigos a la vez; inicialmente era uno por persona. A causa de la alta demanda, incrementé ese número a cuatro por persona. Hoy tenemos a cien mil limosneros con nosotros. A lo largo de cuatro años, diez mil de ellos ya han parado de pedir limosna y algunos, incluso, tienen sus tiendas.

Los noventa mil restantes, yo diría que son mendigos de medio tiempo porque están mezclando su actividad con la venta de objetos. Cuando mis socios se impacientan sobre por qué tardan tanto en salir de la mendicidad les digo: “No los fuercen. Están por cerrar su negocio de limosneros; después de todos estos años, es su negocio, así que no esperen que lo cierren sin más. Al mismo tiempo, están intentando reestructurar su propia profesión, lo que necesita tiempo”. Así que, noso tros no los entrenamos. Nosotros pensamos: “la gente tiene sus propias facetas, saben cuál es su idea, y saben cómo usarla”.

Hoy, nuestros estudios y nuestro monitoreo muestra que el 64% de personas a las que hemos prestado dinero y que han estado más de cinco años con nosotros en Grameen Bank, han logrado cruzar la línea de la pobreza, y ya están por encima de ella. Una nueva generación va a llegar ahora porque todos los hijos de estas familias están yendo a las escuelas, han sido capaces de triunfar, y algunos incluso están recibiendo educación universitaria. Es una nueva generación salida de familias completamente iletradas. Nosotros vemos posibilidad de caminar hacia un mundo donde no haya pobreza para ellos.

Esto es lo que constituye Grameen Bank. Y estamos muy felices. Creemos que la pobreza no es algo creado por la gente pobre: la pobreza es la consecuencia de un sistema que nosotros mismos construimos. Esta es la realidad de la pobreza. Nuestro sistema rechaza el acceso a servicios a casi dos terceras partes de la población mundial. ¿Qué clase de institución es esta? Nos dijeron que lo que queríamos hacer no se podía hacer. Les hemos demostrados que sí se puede, y con mejores resultados que lo que otros han hecho. La gente me pregunta: “¿qué piensa de la crisis subprime?” Y les digo: “no tenemos crisis subprime porque es un negocio muy arriesgado. Nuestro negocio tiene sub, sub, subprime y ni siquiera lo encontramos arriesgado”. Nos sentimos muy cómodos porque la devolución de préstamos es del 98 o 99%.

Ser fuerte es un concepto que se maneja en el mundo de los negocios, en donde ahora sólo hay una idea: el enriquecimiento. No hay otra opción. La maximización de los beneficios es el eje central, así lo dicen los libros. Contrariamente, pienso que la gente que ha creado estas teorías debe creer que todo ser humano tiene una máquina de hacer dinero; sin embargo, el ser humano no es una máquina de hacer dinero. Tener ganancias es una parte importante del hombre, pero no es su totalidad. Un ser humano es mucho más que eso, por lo que yo digo: “¿qué pasa con la otra parte, por qué te la saltas? Esa es la dimensión más interesante del ser humano: dar, cuidar, compartir, contribuir, etc.”.

Todos podemos enderezar esos problemas que el mundo no puede. Porque todos están preocupados por el dinero que van a ganar; cada mañana leen el periódico para ver cuánto dinero obtendrán y esa es toda su obsesión. Con ese tipo de ideas fijas uno se olvida de los demás.